Form 1040EZ: A Simplified Guide to Filing Your Taxes

Table of Contents

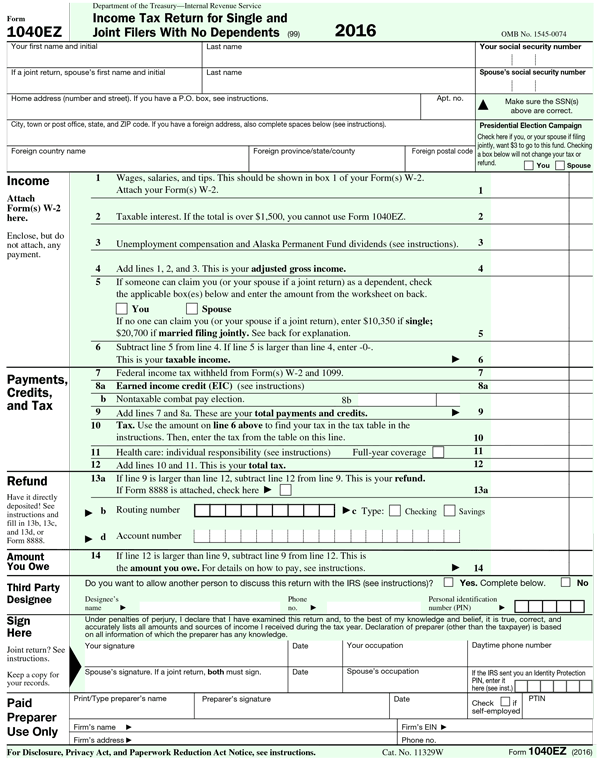

Form 1040EZ

Filing taxes can be a daunting task for many individuals, especially if they are not familiar with the various tax forms and procedures. To simplify the process for taxpayers with straightforward financial situations, the Internal Revenue Service (IRS) introduced Form 1040EZ. This article aims to provide a comprehensive understanding of Form 1040EZ, its eligibility criteria, and the step-by-step process of completing the form.

💡 Key Ideas

-

Form 1040EZ is the simplest and shortest individual income tax return form provided by the IRS.

-

Taxpayers must meet specific eligibility criteria, such as having a low income and no dependents, to use Form 1040EZ.

-

The form is divided into three sections, covering personal information, income and tax details, and signatures for submission.

-

Taxpayers can claim the Earned Income Tax Credit (EITC) if eligible, but itemized deductions are not allowed.

-

The standard deduction is used based on the filing status, and the form can be filed electronically for convenience.

What is Form 1040EZ?

Form 1040EZ is the shortest and simplest individual income tax return form offered by the IRS. It is designed for taxpayers who have uncomplicated financial situations and meet specific eligibility requirements. This form allows you to report your income, claim certain deductions, and calculate your tax liability in a straightforward manner.

Eligibility Criteria for Using Form 1040EZ

To use Form 1040EZ, you must meet the following eligibility criteria:

-

Filing Status: You can only use Form 1040EZ if your filing status is single or married filing jointly. Head of household or married filing separately taxpayers are not eligible.

-

Income Sources: Your income must come from the following sources:

- Wages, salaries, and tips

- Interest income of $1,500 or less

- Unemployment compensation

- Alaska Permanent Fund dividends

-

Income Ceiling: Your total taxable income should be less than $100,000.

-

Age Restrictions: You must be under 65 years old, and if married filing jointly, your spouse must also be under 65. There are no age restrictions if you are filing as single.

-

No Dependents: You cannot claim any dependents on your tax return.

-

No Itemized Deductions: You must not itemize deductions; instead, you will take the standard deduction.

-

No Additional Tax Credits: You can only claim the Earned Income Tax Credit (EITC) if you have no dependents.

If you meet all these criteria, you are eligible to file your taxes using Form 1040EZ.

Steps to Complete Form 1040EZ

Completing Form 1040EZ involves a straightforward process. The form is divided into three main sections, and here's a step-by-step guide to each:

Section 1: Personal Information

In this section, you will provide basic personal details and information about your filing status:

-

Filing Status: Check the appropriate box for your filing status (single or married filing jointly).

-

Name and Address: Write your name, address, and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

-

Spouse Information: If married filing jointly, provide your spouse's name, SSN, and other required details.

Section 2: Income and Tax Information

This section involves reporting your income and calculating your tax liability:

-

Income: Enter your wages, salaries, tips, and any taxable interest received (up to $1,500) in the corresponding boxes.

-

Adjusted Gross Income (AGI): Subtract any adjustments to income, such as student loan interest deductions, from your total income to calculate your AGI.

-

Standard Deduction: Look up the appropriate standard deduction based on your filing status and enter it.

-

Taxable Income: Subtract your standard deduction from your AGI to determine your taxable income.

-

Tax and Credits: Use the tax table provided by the IRS to find your tax liability based on your taxable income. Then, enter any tax credits you are eligible for (e.g., Earned Income Tax Credit).

-

Total Tax: Calculate your total tax by subtracting tax credits from your tax liability.

Section 3: Sign and File

In the final section, you will sign and date your return:

-

Signatures: If filing as single, sign and date the form. If married filing jointly, both spouses must sign and date.

-

Direct Deposit: If you are eligible for a tax refund, you can provide your bank account information for direct deposit.

Submitting Form 1040EZ

Once you have completed Form 1040EZ, you can submit it to the IRS by mail or electronically using e-file options. If you have a tax professional or use tax preparation software, they can also help you file the form electronically.

FAQs (Frequently Asked Questions) about Form 1040EZ

1. Can I use Form 1040EZ if I have dependents? No, Form 1040EZ is specifically for taxpayers without any dependents. If you have dependents, you will need to use Form 1040A or Form 1040, depending on your specific tax situation.

2. I turned 65 during the tax year. Can I still use Form 1040EZ? Yes, you can still use Form 1040EZ for the tax year if you were under 65 at the end of the year. The age requirement applies to your age on the last day of the tax year.

3. What if my taxable income exceeds $100,000 during the tax year? If your taxable income exceeds $100,000, you are not eligible to use Form 1040EZ. You will need to file using Form 1040A or Form 1040, depending on your specific tax situation.

4. Are there any tax credits I can claim with Form 1040EZ? Yes, you may be eligible for the Earned Income Tax Credit (EITC) if you meet the requirements. However, Form 1040EZ only allows you to claim the EITC if you have no dependents. For other tax credits, you will need to use Form 1040A or Form 1040.

5. Can I itemize deductions with Form 1040EZ? No, Form 1040EZ does not allow you to itemize deductions. You must take the standard deduction that corresponds to your filing status.

6. How do I know which standard deduction to take? The standard deduction amount is based on your filing status and is subject to change each tax year. You can find the appropriate standard deduction amount on the IRS website or in the instructions for Form 1040EZ.

7. Can I file Form 1040EZ electronically? Yes, you can file Form 1040EZ electronically through IRS-approved e-file providers. E-filing is a convenient and secure way to submit your tax return and receive any refund owed to you faster.

8. What if I make a mistake on my Form 1040EZ after filing? If you realize that you made an error on your Form 1040EZ after filing, you can file an amended tax return using Form 1040X. This form allows you to correct any mistakes and update your tax information with the IRS.

9. Can I use Form 1040EZ if I have income from self-employment or rental properties? No, Form 1040EZ is only for individuals with simple income sources like wages, salaries, tips, and limited interest income. If you have income from self-employment, rental properties, or other sources, you will need to use Form 1040 or Form 1040A.

10. What is the deadline for filing Form 1040EZ? The deadline for filing your tax return, including Form 1040EZ, is usually April 15th of each year. However, the deadline may be extended to the following business day if April 15th falls on a weekend or holiday.

Remember that tax laws and regulations may change over time, so it's essential to refer to the most recent IRS guidelines and instructions when filing your taxes. If you have any specific questions or concerns about your tax situation, consider consulting a tax professional for personalized assistance.

Conclusion

Form 1040EZ offers a simplified way for eligible taxpayers to file their income taxes. By understanding the eligibility criteria and following the step-by-step guide provided in this article, you can easily navigate the process of completing Form 1040EZ and fulfill your tax obligations efficiently. However, if you have a more complex financial situation or are unsure about certain tax matters, it is advisable to seek assistance from a tax professional to ensure accuracy and compliance with tax regulations.